Canada Is Being Told a Feel-Good Story While Standing on a Fiscal Cliff

We keep being told to relax. That this budget is bold, visionary, transformational, “generational.” We are expected to believe that everything being spent today is not spending at all — but investment — and that somehow this will all magically pay for itself later because the government assures us it will. This feels very much like watching someone at a casino who thinks they cracked the pattern on the roulette wheel because they saw a YouTube clip about probability.

We are not being governed by adults in this moment — we are being marketed to. And while the marketing is polished, the economic reality beneath it is crumbling.

The Carney Government has constructed the single greatest rebrand of public spending in Canadian history. They haven’t reduced risk. They haven’t strengthened the foundation. They simply changed the language — and then told us the numbers now mean something different than they meant before. It is like taking the nutritional label off a chocolate bar, calling it a protein supplement, and expecting us to applaud the transformation.

If public budgeting was this easy, Greece would have been a superpower.

Before we continue, it’s important we ground this in a calm, rational frame. This isn’t about ideology, political branding, or partisan tribalism. This is about arithmetic, structure, and sustainability. Countries that succeed long-term do so because they respect economic physics, not because they are emotionally attached to fiscal narratives. We can disagree on policy direction, but we cannot disagree on math. And the math Canada is betting on right now does not exist in the real world.

This analysis is not written as a partisan counterstrike. We support any government — of any stripe — that produces structural, sustainable fiscal strategy. If this exact budget were proposed by Conservatives, NDP or Greens, the economic critique would remain identical. This is not left vs right. This is reality vs narrative. We simply cannot afford to allow fiscal storytelling to replace fiscal stability.

Why This Budget Matters More Than Any Budget in 40 Years

- This isn’t just another annual spend plan.

- This is a structural turning point.

We are making fiscal decisions today that permanently alter:

- how much future Canadians will pay in tax – that’s your kids, and their kids!

- how much government capacity remains available during global shocks

- whether Canada’s living standards rise or fall over the next generation

- the degree to which debt service eats the national budget going forward

- Budgets are not just ledgers.

- Budgets are national strategy.

And this particular national strategy is being executed during a period of low productivity, high borrowing cost, uncertain global trade flow, demographic aging, and declining investment per worker. This budget is not being launched in a boom cycle. This is not being deployed at the peak of prosperity. This is being launched when Canada is at its weakest structural footing since the 1980s.

And that timing is not a trivial detail. It is the entire point of risk.

SUPPORT THIS WORK

I write these long-form investigative pieces independently — no corporate backing, no political funding, and no sponsor influence. If you value deep, honest analysis that cuts through the narrative noise and speaks plainly to Canadians about issues that truly matter, please consider supporting the work. Even a small contribution helps me continue producing research-based articles like this — freely accessible for everyone.

If this piece informed you, challenged you, or gave you clarity… please consider donating to support future work.

How Canadians Are Being Sold a Fiscal Fantasy

The average Canadian is being told that this is the budget where Canada will finally “go big,” “bet on itself,” and “invest like the future is limitless.” The Carney Government is positioning record spending as though it is a form of national courage.

But here is the uncomfortable truth:

– The risk is not the spending.

– The risk is the belief system behind the spending.

We are being asked to accept that:

- spending is now investment

- operational cost is now capital cost

- deficit is now growth strategy

- and debt is now safe because of redefining how it is measured

This isn’t economics.

This is narrative engineering.

And the danger is that Canadians — who are already stretched by mortgage renewal shock, rising food costs, and collapsing confidence in institutional competence — are being told this is all fine because “this time it’s different.”

It isn’t different. It is the same debt trap every country in fiscal decline enters just before they realize they aren’t who they used to be anymore.

The Basics (For Every Normal Canadian Who Doesn’t Live in Finance)

What a Deficit Actually Means (Plain English)

A deficit is not complicated. A deficit simply means the government is spending more than it collects in revenue.

- If a family does this every month, they go into debt.

- If a business does this long enough, it collapses.

- If a country does this long enough, it loses sovereignty — because debt holders dictate terms.

A deficit can be justified only if the spending produces future capacity that pays back more than it costs (real return).

- If it does not — then it is not investment.

- It is consumption disguised as optimism.

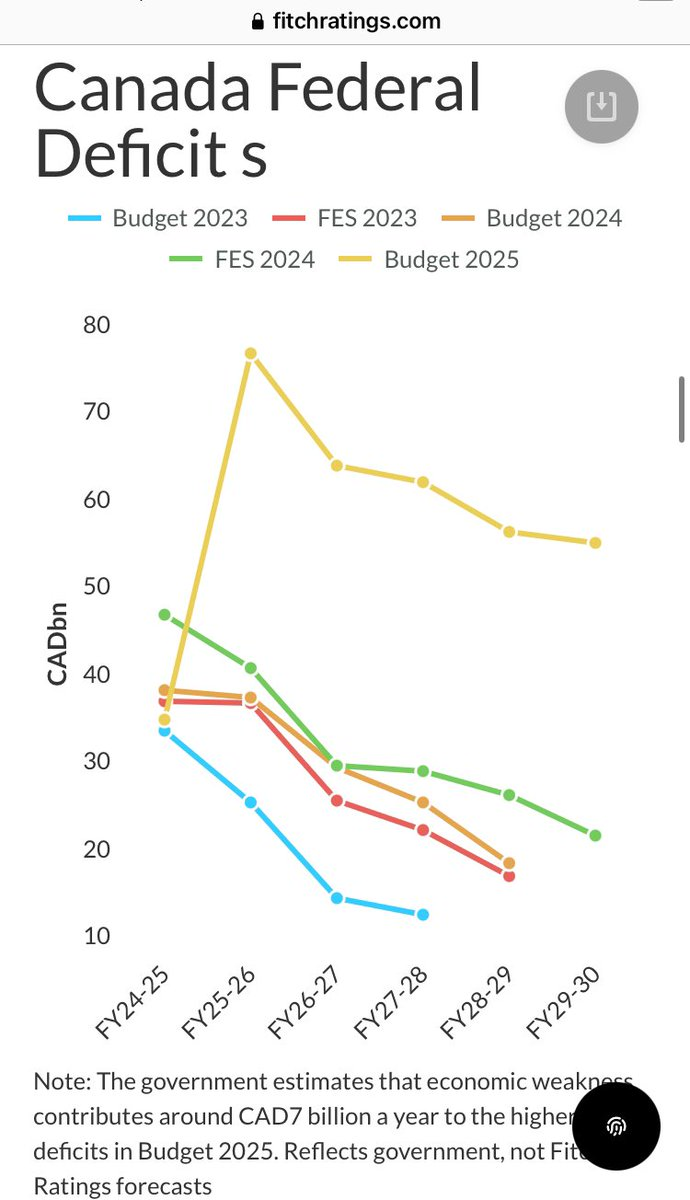

Canada is now running structural deficits — not emergency deficits.

That means the government is doing this voluntarily, not because the economy collapsed, not because of a pandemic, not because of war — but because it chose to. In fact, this planned spending outpaces the spending we did during the pandemic which we were all told, this was only temporary and could not be sustained, well guess what, we now have the 2025 Budget, and THAT is where the danger begins.

The Difference Between Operational and Capital Spending (Why This Matters MASSIVELY Here)

Operational spending is the cost of running government:

- salaries

- healthcare services

- administration

- program delivery

- day-to-day costs of the system

Capital spending is building assets that return value in the future:

- infrastructure

- roads

- power grid

- hospitals

- bridges

- ports

- industrial capacity

Capital spending must produce long-term measurable economic benefit.

Operational spending does not — it maintains existing activity.

This difference is the beating heart of fiscal responsibility.

PMI Definition of Capital Expenditure

According to the Project Management Institute (PMI) — one of the top global standards bodies —

capital expenditures are investments in assets intended to produce future economic benefit, extending beyond one fiscal period.

(PMI Standard for Portfolio Management)

In other words — capital spending is asset creation, not program spending, not social spending, not service expansion, and not government operating cost reframed as “investment.”

This is important because this is where the Carney Government made its most brilliant optical adjustment.

Why Reclassifying Operational Spend as Capital Is a Trick

When you take operational spending — and you rename it as capital — you instantly make the books look more responsible because capital spending is socially framed as “future building.”

So they are taking spending that would normally flag as “ongoing cost”

and instead relabelling it as “long-term investment.”

That transforms politically expensive “consumption spending”

into morally heroic “nation building.”

This is how the Carney Government is lowering what appears to be operational expenditure

without actually lowering spending at all.

- They didn’t reduce cost.

- They moved cost categories.

To the average Canadian looking at headline talking points — this budget now looks disciplined, future-forward, strategic. But underneath the category change — the velocity of spending is actually worse than before. This is the same accounting reframing Big Tech CEOs do before they hand analysts their investor decks so Wall Street won’t ask too many questions. We are watching the exact same playbook executed at a national scale.

The Sleight of Hand That Made This Budget Look Safe

How the Carney Government Reframed Spending as “Generational Investment”

The Carney Government knew that Canadians would panic if they saw record operational spending ballooning in a low-growth environment — because that signals government bloat, not strategic progress.

So instead of reducing spending, they reframed it. They began presenting massive expenditure as “investment in generational capacity”, implying that the money being spent today is guaranteed to produce superior output tomorrow. But “generational investment” only exists when those expenditures meet what PMI — the world’s global project governance benchmark — calls capital:

spending that creates a long-term asset capable of producing future economic benefit.

A majority of what The Carney Government is calling “Generational Investment” is not creating durable economic assets.

It is funding programs, subsidies, bureaucratic mechanisms, transfers, incentive pools, and politically popular initiatives.

In accounting terms — it’s consumption.

In political marketing — it’s nation building.

They didn’t redesign the budget — they redesigned the vocabulary.

The Fast Switch to “Net Debt” — This Is Where They REALLY Pulled It Off

Historically, debt was discussed as gross debt — total liabilities owed by government. Then suddenly — right at the moment this budget needed to look less reckless — the conversation shifted to net debt. Net debt subtracts government-owned assets such as CPP and QPP investment pools and treats them as if they are available to offset government liabilities.

They aren’t.

Those pension assets belong to Canadians — not the federal treasury — and cannot be used to service government overspending without collapsing retirement security. Meaning: The government didn’t lower Canada’s debt risk — it changed what counted as the definition of debt.

And overnight — with that one measurement pivot — Canada went from “highest risk debt trajectory among advanced economies” to “lowest in the G7” in political talking points. It is a masterclass in selective framing.

The Fraser Institute Called This Out — and the Warning Was Clear

In August 2024, the Fraser Institute showed that when using gross debt (the honest measure), Canada falls to one of the worst positioned debt nations in the advanced world:

- 26th out of 32 advanced economies

- and 5th worst inside the G7

But when The Carney Government switches to net debt — suddenly Canada becomes the lowest debt in the G7.

That is not fiscal improvement, it’s simply optics.

And now — the Fraser Institute is projecting that combined government net debt will reach approximately $2.3 trillion, or around 75% of GDP by 2025/26.

That is how serious this is. So we now have a government that is:

- renaming operational spending as capital spending

- renaming debt as net debt

- renaming deficits as generational investment

Not to change fiscal reality

but to change public perception of it.

This is not how a strong country behaves.

This is how a country disguises the beginning of decline.

Canada’s Structural Weaknesses (Why This Budget Is Extra Dangerous)

The Collapse of Productivity Growth

We cannot ignore this part because it is the core math behind national strength. Canada’s GDP has grown primarily because our population has grown — not because the average Canadian worker is producing more value per hour. When you strip out the population inflation effect, the country is actually stagnating at a productivity level that hasn’t meaningfully improved in 10+ years. This is like claiming you are getting richer because you had more kids — even though each kid earns less than before.

That is not growth.

That is dilution.

We are a nation adding more people into a system producing less per person — and then calling the resulting bigger number success.

So when The Carney Government pushes a historic spending agenda into an economy without productivity capacity behind it — we are not investing into strength — we are inflating weakness.

Deficit spending during high productivity cycles is cushioning.

Deficit spending during low productivity cycles is compounding damage.

Why Private Capital Is Quietly Leaving

Capital rarely leaves a country loudly.

It doesn’t make a press release.

It simply chooses a different jurisdiction quietly.

This is already happening. Companies shelve expansions instead of announcing cancellations. Manufacturers redirect next plant expansion to the U.S. instead of Ontario. Engineers shift IP domicile internationally.

Pension funds choose offshore infrastructure instead of domestic.

Capital flight is mostly silent — until the impact arrives in tax revenue, lost jobs, weaker investment multipliers and a shrinking industrial base.

We already see that in Canada’s investment-per-worker metrics. OECD confirms it: Canada invests less per worker today than a decade ago. The U.S. invests significantly more per worker — which means the gap becomes cumulative annually.

This matters because this budget assumes capital will suddenly return and surge.

So this spending is built on hope, not data.

Regulatory Drag + Carbon Policy Instability

We are not losing capital solely because of tax or labour cost.

We are losing capital because Canada is one of the slowest, most uncertain jurisdictions in the advanced world to greenlight major industrial projects.

- long permitting cycles

- fragmented provincial-federal regulatory overlaps

- unstable carbon frameworks that keep shifting

- extreme timeline uncertainty

Investors do not fear clean energy.

They fear unpredictable frameworks and moving target rules.

Germany proved this.

The UK proved this.

Japan lived it for two decades.

The Carney Government is trying to deploy a growth budget in a country where structural friction prevents capital from scaling into the real economy at the speed required.

Money cannot multiply inside policy environments that slow it down.

Sector Case Risk: Energy, Mining, Auto

These sectors are critical to Canada’s long-term strategic balance sheet.

Energy:

Massive project deferrals continue because investors don’t trust timeline certainty.

Mining + Critical Minerals:

We are rich in resources but poor in permitting speed.

Critical minerals are useless in the ground.

Auto Manufacturing / EV Transition:

Our entire EV spend strategy depends on global demand that is already softening AND requires capital follow-through that hasn’t shown up yet.

Canada is acting like it is deploying capital into a boom cycle — when the cycle is still in uncertainty. This creates the worst possible macro setup: structural weakness + exponential spending.

International Lessons (Countries Who Tried This…and Paid for It)

We are not the first nation to believe we could spend our way into strength.

History already ran this simulation several times.

Germany — The Industrial Slow Bleed

Germany entered its energy transition aggressively — but without predictable cost stability, clear industrial timelines, or regulatory speed.

What followed was a decade-long erosion of industrial competitiveness.

Companies didn’t storm out all at once.

They slowly stopped expanding. They paused plants. They reassigned capital abroad.

Manufacturing output stagnated.

Energy cost uncertainty destroyed forward planning.

Major chemical giants like BASF permanently redirected capital out of the country. Germany didn’t collapse suddenly — it slowly lost altitude until the ground arrived.

Canada is lining up the same variables:

slow approvals, shifting frameworks, optimistic projections, weak productivity base.

The United Kingdom — The Sovereign Narrative Crash

The UK believed it could outspend stagnation while maintaining narrative power over markets. But eventually markets demanded reality. The UK government was forced into humiliating U-turns, policy reversals, tax collapses, and fiscal credibility trauma that took YEARS to rebuild.

Canada is now structurally closer to that scenario than our leaders will admit publicly.

Narrative collapses fast.

Trust collapses faster.

Japan — The Decade of Stagnation

Japan’s lost decade wasn’t caused by one crisis. It was caused by believing future growth was automatic and guaranteed — and spending like it was pre-paid.

Canada is dangerously near the same curve:

- demographic aging

- declining per capita productivity

- high public debt

- weak investment return velocity

- spending based on future capacity that does not exist yet

Once you enter stagnation — it’s extremely hard to climb back out.

These are not academic comparisons.

These are warnings.

They show us EXACTLY what happens when governments bet future capacity before it exists. This is precisely why Budget 2025 is not just a fiscal document… it is a national risk accelerant.

The Global Investor Confidence Signal

Bond markets don’t care about campaign messaging — they care about whether a government is behaving like the risks it faces are real. When credibility erodes, the cost of borrowing rises — silently at first, then violently. This is how UK gilt markets imploded in 2022, forcing emergency central bank intervention. If Canada loses fiscal narrative credibility the way the UK did — we will not be insulated because of our polite brand or stable banking system. We will get punished the same way. Markets believe numbers — not speeches.

Capital Flight — The Canadian Reality We Are Already Living

Here is the part most Canadians are never told: capital almost never leaves dramatically in one single political moment. Capital leaves quietly. Gradually. Deal by deal. Factory by factory. Project by project. Until one day the country wakes up and wonders “when did everything get so expensive and so weak at the same time?”

This is not theoretical.

This is happening right now.

Canadian auto investment is already re-weighting into the United States — driven by faster permitting, more predictable tax frameworks, and regulatory certainty. Global mining firms are allocating capex to Latin America and Australia because Canada’s regulatory approval duration has become non-investible. Even AI venture formation — one of the few sectors Canada still claims moral leadership in — is increasingly favouring US state incorporation because of scale, capital formation velocity, and lower policy-risk exposure.

Capital flight is not loud.

It is silent structural collapse.

It is the absence of a factory that will never be built.

It is the startup that never domiciles here.

It is the mineral deposit that never gets extracted on Canadian soil.

THIS is the irreversible national damage Budget 2025 accelerates. As debt grows — but the productive tax base shrinks — the fiscal trap becomes exponential. When capital leaves, the future tax base leaves with it. You do not get it back by speeches. You do not get it back by campaign messaging. You only get it back by making Canada economically rational again.

Global Investor Confidence: The Warning Shot Canada Is Ignoring

Bond markets do not respond to campaign messaging — they respond to behaviour.

When a government demonstrates it no longer respects economic risk signals, the cost of borrowing rises long before the public ever notices. This is exactly what happened to the United Kingdom in 2022 when gilt markets collapsed after the Truss mini-budget. Their central bank was forced into emergency sovereign defence — not because Britain was weak, but because confidence evaporated instantly when markets perceived “magical fiscal thinking.” Canada is not immune to this.

Our debt markets behave the same way every other G7 debt market does. And if foreign investors perceive that Budget 2025 is structured on unrealistic growth assumptions and political relabelling instead of disciplined capital strategy — yields will rise here exactly as they did in the UK.

This is the part ordinary Canadians never see — because the punishment begins outside Canada’s borders before it hits inside them.

Global capital does not punish slowly.

It punishes suddenly.

And once the confidence break happens, governments lose control over their future. The market takes over — and the only tools left are austerity, tax hikes and forced constraints. That is what this budget risks triggering if the economic assumptions fail.

Canada is gambling that markets will continue believing a growth story that no longer mathematically matches reality.

Markets won’t tolerate that forever.

The Core National Risk

Canada is betting its future on conditions that do not exist.

That is the entire problem distilled into one single sentence.

The Carney Government has constructed a budget that only works if the world behaves perfectly, if private capital suddenly floods back into Canada against all current evidence, if productivity spontaneously rebounds after a decade of stagnation, if interest rates stay gentle, if geopolitical risk stays muted, and if everything that can go wrong — simply doesn’t.

This budget isn’t built for the real world.

It is built for a theoretical world — a world where nothing unexpected ever happens, no external crisis hits, no major global recession hits, no energy shock hits, no U.S. political convulsion hits, no global capital pullback happens, and no structural constraint disrupts the narrative Canada is trying to sell.

This is the financial equivalent of building a national retirement plan on the assumption that you will win the lottery at 65.

We cannot call this “investment.”

We must call this what it is: risk transfer to the future.

And here’s the part Canadians need to understand clearly:

If private investment does not explode upward exactly on schedule…

this budget collapses under its own math.

Canada does not currently have:

- the productivity base

- the capital formation velocity

- the regulatory speed

- the innovation conversion

- or the geopolitical insulation

required to sustain the spending trajectory being proposed.

This is not ideological criticism.

This is arithmetic.

We are being given the most optimistic fiscal path at the most pessimistic global timing window.

And if that timing is wrong — even by 18 to 36 months — the consequences compound into a debt spiral Canada will not easily escape.

The Debt Spiral Explained Plainly (This Is How It Starts)

Debt spirals do not begin with catastrophe.

They begin quietly — with assumptions.

A debt spiral is what happens when debt grows faster than the ability to generate income to service that debt. It is like maxing out credit cards faster than your pay raises arrive — and then raising your credit limit every time the bill gets harder to pay.

At first, nothing looks wrong. Then one day — the minimum payment becomes the crisis.

For a country, the “minimum payment” is interest cost.

Once interest consumes too much oxygen inside the federal budget, investment into real value stops — and government is stuck maintaining the debt machine instead of building a future.

You don’t feel this overnight.

You feel it slowly — as every federal dollar becomes less effective, less impactful, less generative, and more self-consuming.

Intergenerational Balance Sheet Theft (Yes, That Is The Correct Term)

The reason this matters isn’t just because we’ll pay more tax.

It’s because our children and grandchildren will have LESS economic leverage than we did.

This is like a parent refinancing the house repeatedly to pay for short-term lifestyle upgrades — then handing the mortgage to a kid who hasn’t even gotten their first real job yet. Canada is doing this at scale.

We are loading obligations onto people who haven’t even entered the workforce — in some cases haven’t even been born yet — to subsidize spending that isn’t building durable capacity, but rather soft consumption disguised as capital.

When we talk about “generational fairness” — THIS is the real frontline.

Not slogans. Not campaign messaging.

This debt structure is the policy assault on future Canadians.

How Living Standards Actually Fall — Silently, Then Permanently

Living standards do not collapse through sudden disaster.

They erode through slow economic suffocation.

It starts with:

- higher taxes

- smaller program envelopes

- tighter provincial budgets

- reduced industrial employment

- reduced innovation

- slower wage growth

Then the big slide happens:

Canada becomes less competitive for capital — so capital stops coming. This is like a sports team that stops attracting elite players. Once the pipeline dries up — the culture shifts — then the decline becomes structural.

Budgets are not political weapons.

Budgets are national destiny.

And this one is steering us into future where Canada slowly becomes a lower standard-of-living country relative to peer nations — even while politicians insist everything is fine.

What Canada Should Actually Be Doing Instead (The Real Adult Strategy)

If we strip away the marketing, the slogans, the focus-tested “generational” language, and look at this like responsible adults — there are only three major levers that actually matter if Canada wants a future that is sustainable instead of fragile.

These aren’t partisan.

These aren’t ideological.

These are structural physics of modern productive economies.

And they are the only path forward if we want to avoid the slow national decline we just finished describing.

1) CUT REGULATORY TIMELINES — NOT PROGRAM PROMISES

The single greatest competitive disadvantage Canada has today is not tax.

It is TIME. Capital doesn’t fear cost nearly as much as it fears uncertainty.

If it takes 7–10 years to get a mining project, energy project, grid upgrade, port expansion, or hydro build approved — capital simply leaves.

We need to compress regulatory timelines to top-quartile OECD speeds.

- Publish timelines.

- Publish enforcement.

- Publish outcomes.

Government MUST:

- set statutory regulatory decision clocks

- force departments to decide faster

- enable project approvals within rational industrial timelines

Canadians MUST:

- demand Parliament stop weaponizing delay

- demand performance accountability in permitting

- refuse narrative politics as a substitute for delivery

This is like telling a construction contractor:

you have 90 days to finish framing — not “finish whenever you get to it.”

The entire economy speeds up when policy stops slowing it down.

2) CAPITAL DEEPENING MUST BECOME NATIONAL CORE STRATEGY

Right now Canada is still trying to grow the economy through population expansion rather than productivity expansion.

That is like hiring more workers without giving them tools.

Capital deepening = more machinery, automation, modernized software, advanced infrastructure per worker. That is what lifts wages, creates higher value output, boosts tax revenue, and protects the standard of living.

Government MUST:

- provide full expensing & super deductions for machinery, technology, automation

- measure capital deepening explicitly as a national KPI

- benchmark Canada against U.S. + OECD peers quarterly

Canadians MUST:

- stop accepting “GDP growth” headlines that are only population growth

- demand labour productivity become a political scoreboard metric

- expect better economic math than magic narrative

Productivity is the engine.

Government spending is NOT the engine. This budget confuses the fuel with the engine.

3) STABILIZE THE NATIONAL CARBON + ENERGY FRAMEWORK FOR 10 YEARS MINIMUM

Clean energy, EV strategy, hydrogen, grid modernization — these only work if capital can trust the rules.

We can’t rewrite carbon policy every election cycle.

We can’t make decarbonization political theatre.

Investors don’t commit billions into frameworks that might reverse, adjust, pause or flip depending on which colour wins 24 seats in swing ridings.

Government MUST:

- lock a carbon framework nationally for 10 years

- align provinces with one predictable system

- establish border carbon equalization (to protect trade-exposed industry)

Canadians MUST:

- demand stability instead of moral signalling

- demand decarbonization be performance-based, not PR-based

This is like telling a bank you want a mortgage with a rate that might randomly change every month because you like excitement.

They would laugh you out of the branch.

Capital does the same thing.

Canada Still Has Time — But Not Unlimited Time

We still have an opportunity window to course-correct. We still have national talent, resources, and innovation culture. But the window is not infinite.

And Budget 2025 accelerates the countdown — it doesn’t delay it.

Canada is standing at the edge of a fiscal cliff — and The Carney Government is telling us to enjoy the view. They are calling this “Generational Investment” while quietly reclassifying spending, redefining debt, and trying to convince us that arithmetic no longer applies to our country.

You don’t escape reality by renaming it.

We cannot spend our way into prosperity while investing less capital per worker than almost every comparable advanced economy. We cannot call operational spending “capital” because it makes the narrative look heroic. We cannot pretend that pension assets are debt offsets. We cannot claim we’re safe because we changed the label on the can.

This is the oldest trick in politics:

when the numbers don’t look good — redefine the numbers.

Canada is not immune to consequence because we are polite, or resource rich, or morally superior, or because our leaders tweet earnest slogans about fairness and solidarity. Countries fall when they confuse accounting smoke tricks for strategy — and history is full of nations who believed they could out-narrative economic gravity.

Canada is betting the house, the barn, and the future grandkids’ RESP accounts… on a hunch.

And if this doesn’t land with Canadians, nothing will:

If future growth doesn’t come exactly on schedule — Canada gets crushed.

- Not symbolically.

- Not metaphorically.

- Literally crushed — under debt load, under interest cost, under permanently lower living standards.

This is the part nobody in government will say out loud:

Bad fiscal decisions in one generation destroy the trajectory of the next.

We have ONE job now as a country:

- demand transparency

- demand honest accounting

- demand capital deepening over population inflation

- demand regulation timelines be practical not performative

- demand a real carbon framework not a policy roulette wheel

Government must change course — not after the crash — BEFORE.

Because if we wait until markets force accountability, the cost will be unthinkably higher, and Canadians will be told “no one could have seen it coming.”

Except we did see it. We are seeing it right now, and it is time we stop pretending that renaming failure will magically turn it into success. This budget isn’t generational investment. It is generational transfer of risk — dressed up as visionary nation building.

And if we don’t call it out now — the long-term damage won’t be reversible.

Leave a comment