At the end of the day, we could spend 40 pages clinically dissecting line items, amortization tricks, capital v. operational categorization strategies, IMF qualifiers, productivity illusions, and CER fantasy land — but none of it actually matters if Canada cannot support the weight of this spending trajectory.

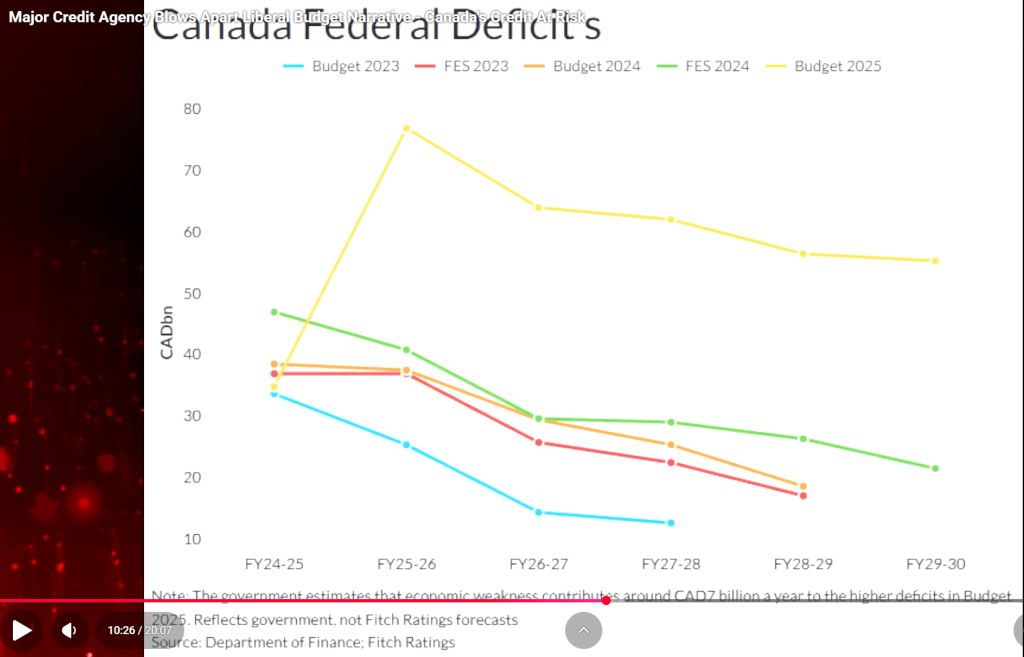

Look at the chart.

Deficits are now not just “continuing”; they are structurally accelerating. Budget 2025 projects spending levels that are completely disconnected from execution capacity, economic growth reality, and most importantly — fiscal endurance. If the global economy even hiccups… Canada is in catastrophic territory.

This is the core failure.

Regardless of whether they stamp it as capital or operational — the money is coming from the same pot.

And Canada no longer has a pot deep enough to sustain a budget framework built on hope, reclassification, and narrative. We don’t have financial slack left. We don’t have fiscal oxygen left. We are one global shock away from getting crushed under our own policy romanticism.

Look around the world — we already have proof of where this road leads.

• Greece – narrative spending and denial collapsed the country

• Italy – chronic over-extension + weak growth became structural insolvency pressure

• Spain – ignored execution reality, and austerity was forced upon them by markets

• Ireland – spectacular boom → reckless leverage → systemic implosion

Each of these countries believed the same thing Ottawa believes now: that optimism, branding, and future-growth assumptions could outpace math. Each of them believed they were uniquely immune to the consequences of structural overspend.

History is not subtle about how it ends.

Canada is not exempt from arithmetic.

And this becomes especially dangerous when you combine this fiscal recklessness with domestic economic abandonment: businesses leaving the country, automotive manufacturing declining, investment fleeing our regulatory environment, and our own government tying our most monetizable national asset — energy — behind a performative green optics campaign that isn’t decarbonizing anything at meaningful scale anyway.

We are voluntarily shrinking our industrial engine while accelerating our spending engine.

This is how sovereign fragility begins.

Canada is not collapsing yet — but we are not acting like a nation trying to prevent collapse. We are acting like a nation that believes collapse is impossible simply because we are convinced we are “Canada.”

Reality does not care about slogans.

This budget is not merely overly ambitious — it is structurally dangerous. Because everything in it assumes the world will cooperate, capital will appear on cue, and Canada will magically execute like Singapore while regulating like San Francisco and spending like France.

That is not a strategy.

That is fiscal assisted suicide by optimism.

If this spending path holds — one serious global disruption is all it takes to turn a credit challenge into a credit event.

Canada is running out of margin for error. And Budget 2025 accelerates the countdown — not away from risk — but directly toward it.

Leave a comment