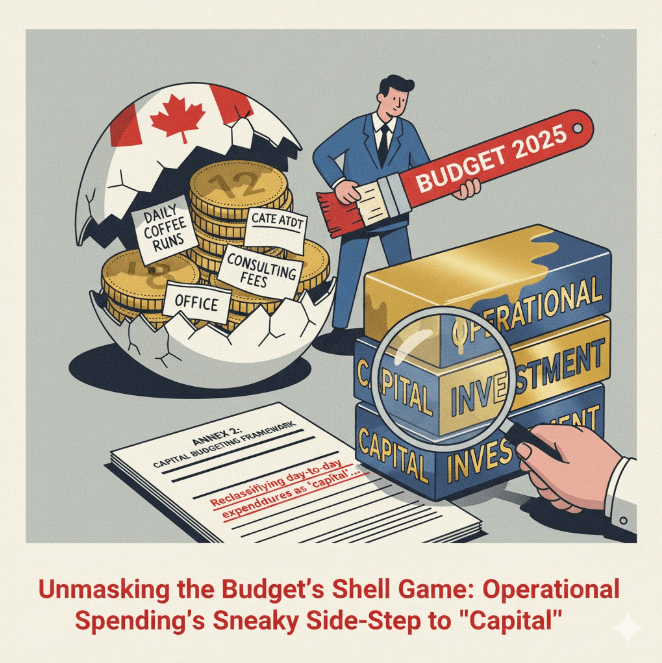

Unmasking the Budget’s Shell Game: Operational Spending’s Sneaky Side-Step to “Capital”

Preamble….Diving into the 2025 Federal Budget: A Page-by-Page Autopsy (Because Someone Has to)Alright, fellow Canucks – I’ve cracked open the 2025 Federal Budget like it’s a mystery novel, but instead of whodunits, it’s who-didn’t-see-this-fiscal-fireworks-show-coming. Plan: I’m reading it page by page, and whenever I hit something noteworthy – be it a gem, a gut-punch, or just plain “WTF?” – I’ll post a quick breakdown here. No fluff, just the receipts.My first skim? Yikes.

There’s some next-level financial wizardry afoot – think operational spending getting a sneaky makeover into “capital investments” to make the numbers sparkle like a fresh loonie. And the optimism? It’s all-in Vegas-style: swinging for the fences on growth projections that assume the economy plays nice, inflation chills out, and global headwinds turn into tailwinds. We all know the drill – the economy’s a wild bronco, not a predictable Timmy’s run. This blueprint needs the kind of luck an aggressive stock picker’s wet dream delivers… and spoiler: those portfolios? They crash harder than a Habs playoff hopes more often than not.

Over the next several days and weeks, stick around if you want the unvarnished tour. First stop: that Capital Budgeting Framework on page 247. Buckle up – it’s gonna be a ride. What’s your biggest budget beef so far? Drop it below. #Budget2025 #FiscalRealityCheck

Here We Go!

Ah, the Capital Budgeting Framework – Budget 2025’s shiny new toy, dressed up as a bold pivot toward “generational investments.” But as you astutely flagged, it’s got that whiff of fiscal sleight-of-hand: reclassifying what used to be straight-up operational expenditures as “capital” to paint a rosier picture of slashed day-to-day spending and ramped-up long-term bets. It’s like calling your daily Tim Hortons run a “productivity investment” because it fuels your morning brainstorm – technically true, but come on.

The smoking gun? Right there in Annex 2: Capital Budgeting Framework of the official Budget 2025 document, kicking off the whole shebang with the exact line from your screenshot:

“The government is introducing a capital budgeting framework to modernise our approach and deliver generational investments. This framework clearly distinguishes day-to-day operational spending from long-term investments that strengthen our economy—changing the architecture of government fiscal planning to deliver greater investment and growth for Canadians.”

This isn’t just fluffy rhetoric; it’s the blueprint for the switcheroo. The framework “broadly defines” capital investments to scoop in a grab-bag of goodies – think transfers to provinces for infrastructure, tax breaks for R&D, even “support to unlock large-scale private sector capital investment” via operating subsidies tied to contracts.

budget.canada.ca Suddenly, stuff that smells like ongoing ops (salaries? Nah. But hey, amortizing federal assets over decades? Capital gold!) gets shuffled into the “long-term” pile. The result? Operational spending looks leaner on paper – they’re projecting an operating budget balance improving to -0.3% of GDP by reclassifying 1.4% to 1.7% of GDP worth of expenditures as capital from 2025-26 onward.

ca.rbcwealthmanagement.comTo break it down without the jargon haze:

| Category | What’s Getting “Capitalized”? | Why It Feels Sneaky | Projected Impact (Over 5 Years) |

|---|---|---|---|

| Capital Transfers | Funds to provinces/Indigenous groups explicitly for building assets (e.g., roads, not unrestricted cash). | Blurs lines – what was a general transfer becomes “investment” if strings are attached. | Part of ~$450.6B total capital spend on cash basis. budget.canada.ca |

| Tax Incentives | Corporate breaks for machinery, IP, or housing builds. | Ongoing tax perks (ops in disguise) now count as growth fuel. | Boosts annual capital from $32.2B (2024-25) to $59.6B (2029-30). budget.canada.ca |

| Asset Amortization | Spreading costs of fed-owned stuff (planes, buildings) over useful life. | Turns immediate expenses into multi-year “investments.” | Aligns with accrual accounting for “transparency,” but hides upfront hits. |

| R&D & Housing Boosts | Grants/tax credits for private R&D or new home supply. | Lumps in productivity programs that feel operational. | Ties to “intergenerational fairness” – borrow for future wins, not today’s bills. |

The annex spells it out: this setup lets Ottawa “prioritise the latter [capital] and help deliver lasting benefits,” while keeping the deficit leash loose for borrowing on capital alone (à la Singapore or UK models).

budget.canada.ca Critics are already calling it the “Patience Budget” – all big-bet infrastructure dreams, but with operational cuts that are more mirage than meat cleaver.

finance.yahoo.com It’s intergenerational equity on steroids: today’s ops bloat gets relabeled, tomorrow’s kids foot the interest bill for shiny new warehouses.

If this is the “modernisation” Carney’s crew promised, it’s less a framework and more a funhouse mirror – everything’s distorted just enough to sell the sizzle without the steak. Your screenshot nailed it: they allude to the shift without shouting it. But now we’ve got the full annex spotlighted – the proof in the fiscal pudding.

…stay tuned.

Leave a comment