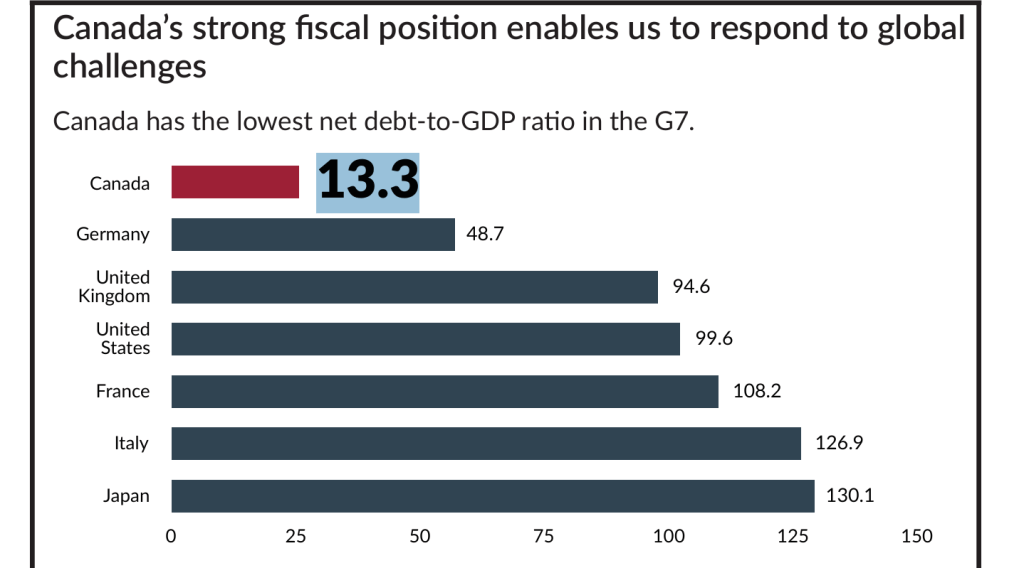

Folks, if you’re Canadian and you’ve just cracked open the latest federal budget—like, the one that dropped today, November 4, 2025, with all the subtlety of a moose in a china shop—you might have seen that shiny bar graph. You know the one: “Canada’s Strong Fiscal Position Enables Us to Respond to Global Challenges.” And right there, in glorious red, Canada’s net debt-to-GDP ratio at a measly 13.3%, the lowest in the G7. Germany? 48.7%. The U.S.? Almost 100%. Japan? Over 130%, because apparently they invented debt like they invented sushi. “Look at us!” it screams. “We’re the fiscal equivalent of Switzerland—neutral, boring, and sitting on a pile of gold!”

Cue the applause. Or, if you’re me, cue the eye-roll so hard it could generate its own wind farm up in the Rockies. Because this chart isn’t a badge of honor; it’s a sleight-of-hand worthy of David Copperfield, if Copperfield had a fetish for pension plans and a government expense account. Let me pull back the curtain on this fiscal funhouse mirror, Maher-style: We’re not the thriftiest kids on the G7 block. We’re just the best at cooking the books with grandma’s retirement savings. And trust me, when the bill comes due, it’s not gonna be pretty.

First off, let’s talk about what “net debt” really means, because if the government wanted transparency, they’d call it “net debt, asterisk, fine print buried in a PDF thicker than a Tim Hortons lineup.” Net debt subtracts “financial assets” from your total liabilities—like, hey, we’ve got some cash stashed away, so our debt doesn’t look that bad. For Canada, that stash includes about $717 billion (and climbing) from the Canada Pension Plan and Quebec Pension Plan. That’s right: They’re dipping into your future nest egg to make the national balance sheet look like it belongs to a Scandinavian trust-fund kid.

But here’s the kicker—and it’s a stinger: Those pension bucks? They’re not for paying off the national credit card. They’re locked in a vault labeled “Do Not Touch: Future Retirees Only.” You can’t raid the CPP to fix potholes in PEI or bail out the next housing bubble. It’s like if I subtracted my Netflix subscription from my bar tab and called myself “debt-free.” The Fraser Institute—those fiscal scolds who make accountants look like party animals—pegs it perfectly: Strip out the pension fairy dust, and Canada’s “impressive” 13.3% balloons to 30-35% net debt-to-GDP. Still better than Italy’s eternal siesta of spending, sure. But lowest in the G7? Nah, that’s like winning the marathon because you took the bus for half the race.

And don’t get me started on the gross debt side, where the government’s playing ostrich with its head in the sand. Gross debt-to-GDP? We’re talking 65-75% across all governments—federal, provincial, municipal, even that guy in Nunavut who owes money to the Hudson’s Bay Company. That puts us smack in the middle of the G7 pack, 26th out of 32 advanced economies. Congrats, Canada: We’re not Greece, but we’re no Germany either. We’re the fiscal version of that middling NHL team that makes the playoffs on a technicality—exciting for a week, then crushed in the first round.

Why does this matter? Because while Ottawa’s high-fiving over this cherry-picked chart, the real story is a slow-motion car crash. Federal deficits? Projected at $78 billion for 2025-26—the third-highest ever outside a pandemic or war. That’s not “responding to global challenges”; that’s responding to every lobbyist with a Timbit and a sob story. Housing costs through the roof, productivity flatter than poutine after a food fight, and now we’ve got a government bragging about fiscal virtue while quietly borrowing like it’s going out of style. It’s hypocrisy on hockey skates: “We’re fiscally responsible! Pass the poutine—and the stimulus checks!”

Compare us to the rest of the G7 without the smoke and mirrors. Germany doesn’t get to net out a massive pension slush fund because theirs is invested in… wait for it… German bonds. It’s like owing yourself money—poetic, but it doesn’t make you richer. The U.S.? Social Security’s a black hole of IOUs to Uncle Sam. Japan? Their pensions are so underwater, it’s basically fiscal haiku about drowning in yen. No, Canada’s the outlier here, the kid who aced the test by “accidentally” seeing the answers. Economists like Carmen Reinhart—yeah, the debt whisperer—have been yelling this from the rooftops: Pension trust funds don’t magically erase deficits. They’re promises to pay later, and with CPP liabilities clocking in at 3.4 times the assets, “later” might mean your grandkids footing the bill while you sip Ovaltine.

Look, I get it. In a world where Trump’s tariff tantrums and Europe’s energy meltdowns make every budget feel like a crapshoot, a little patriotic spin is tempting. But this? This is the fiscal equivalent of those Instagram filters that shave 10 pounds off your beer gut. It looks great in the feed, but when the lights come on, reality bites. Canada’s got a AAA credit rating and room to maneuver—props for that. But pretending we’re the G7’s golden child based on a metric that’s basically “debt minus stuff we can’t spend anyway” is insulting to anyone with a calculator or a pulse.

So here’s the scorched-earth truth, straight no chaser: Ditch the chart, Finance Minister. Show us the gross numbers. Admit the pension ploy. And for God’s sake, stop treating taxpayers like rubes at a magic show. Because when the global challenges hit—and they will, faster than a Zamboni on ice— we need real fiscal muscle, not illusions. Otherwise, that “strong position” is just a fancy way of saying, “Hold my Molson while I juggle these grenades.”

Wake up, Canada. The show’s over. Time to pay the piper—and maybe invest in some actual pipes that don’t leak.

Leave a comment