Ah, Canada—our polite, maple-syrup-soaked paradise, where the biggest drama used to be whether Tim Hortons runs out of double-doubles on a holiday.

But lately? It’s like watching a slow-motion train wreck directed by a committee of drunk uncles: the Liberal government, under the slick-suited Mark Carney, preaching “sacrifices” while rifling through your wallet like it’s an all-you-can-eat buffet.

In his pre-budget TED Talk to university eggheads last week, Carney dropped the mic with this gem: Canadians must brace for “sacrifices” to fund his grand vision of “generational investments.”

(Source: thestar.com)

His language was not hyperbole. According to a CBC News report (Oct 22, 2025), the Prime Minister explicitly told Canadians to ‘prepare for some ‘challenges’ and ‘sacrifices’.’ When pressed for specifics, the CBC noted Carney ‘wouldn’t provide specifics, indicating instead that they would be revealed in the budget.

As one analyst at Business in Vancouver (Oct 23, 2025) put it, ‘Carney is asking Canadians to accept near-term pain for a long-term payoff… but it’s also a billboard for opponents.’

You know, the kind where today’s kids foot the bill for tomorrow’s electric buses that might spontaneously combust, all while housing prices climb higher than a Mountie on stilts.

If this sounds like Trudeau 2.0 but with fancier jargon and a Bank of England pedigree, that’s because it is.

Carney—the golden boy who promised fiscal prudence like a vegan at a steakhouse—is now swinging for the fences with a bat made of borrowed billions.

And the backlash? It’s everywhere—from X rants that could curdle poutine to op-eds screaming “debt crisis incoming.”

Even Pierre Poilievre, the Conservative attack dog with the charisma of a caffeinated beaver, is piling on, reminding us that under Liberals, Canada’s economy is the G7’s sad-sack underachiever: lowest per-capita GDP growth, highest household debt, and a deficit that’s ballooned like a bad facelift.

(Source: ca.news.yahoo.com)

The Liberal Spending Spree: From “Temporary” Deficits to “Eternal Damnation”

Flash back a decade, when Justin Trudeau slithered into power promising sunny ways and deficits that’d vanish faster than a politician’s principles.

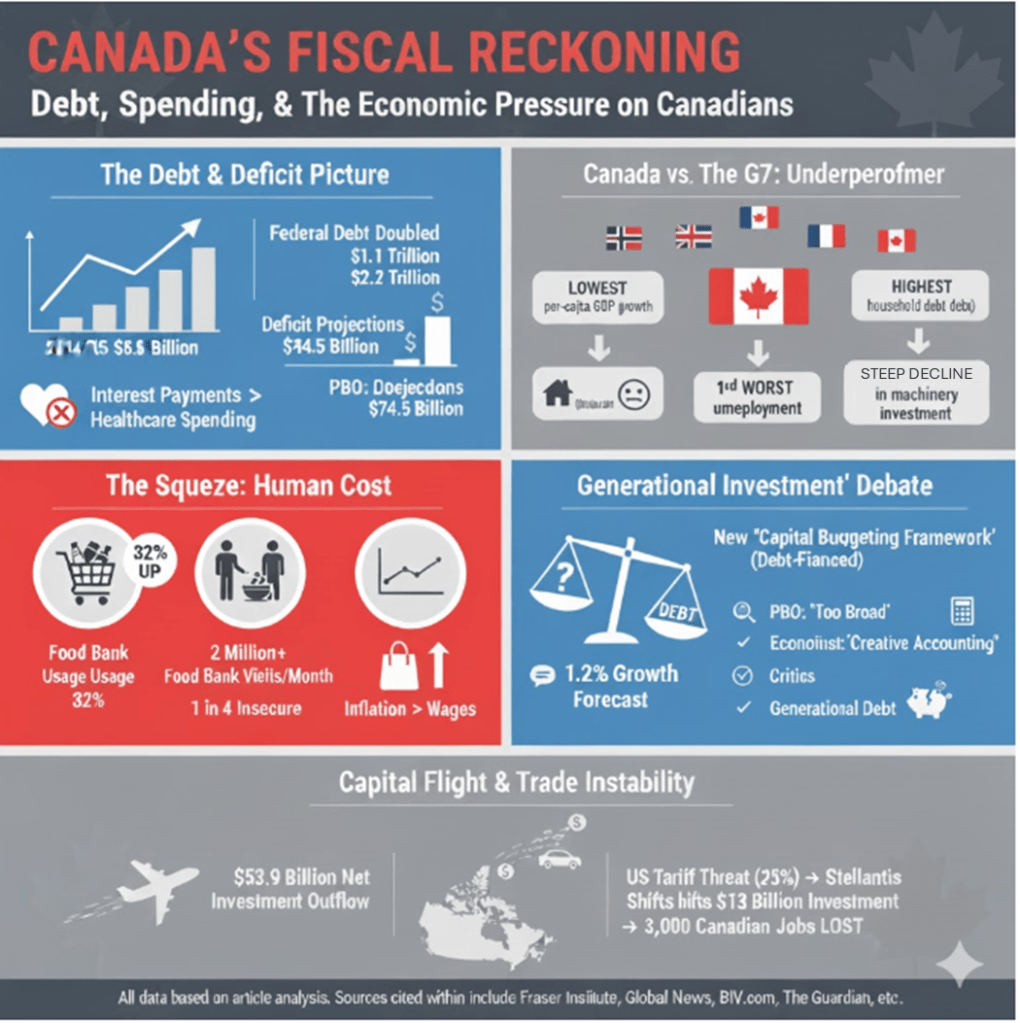

Spoiler: they didn’t. Under the Trudeau-Carney tag team, federal debt has doubled from $1.1 trillion (2014/15) to a projected $2.2 trillion (2024/25).

(Source: fraserinstitute.org)

That’s not fiscal policy; that’s a fire sale on Canada’s future.

The Parliamentary Budget Officer (PBO) now pegs this year’s deficit at $68.5 billion—up sharply from earlier estimates, thanks to U.S. trade tantrums and Carney’s capital-spending fever dream.

(Source: globalnews.ca)

The Parliamentary Budget Officer (PBO) confirmed this figure in its September 2025 ‘Economic and Fiscal Outlook,’ projecting the deficit ‘will increase sharply to $68.5 billion.’ The PBO also expressed concern that ‘the federal debt-to-GDP ratio is no longer projected to be on a declining path.’

Interest payments on that debt now eclipse what we spend on healthcare.

As one X user quipped: “Liberals have spent us into oblivion… Future generations are truly screwed.”

(Source: marksdeepthoughts.ca)

In an official letter, Poilievre’s Conservative Party (October 2025) laid out the figures: ‘There are over two million visits by Canadians to food banks every month… It is no coincidence that as the Liberal government doubled the debt, housing costs and food bank lineups doubled as well.‘

Economist Trevor Tombe, analyzing the PBO’s data for The Hub (Oct 1, 2025), calculated that ‘interest costs alone may consume 14 cents of every dollar in government revenue by 2030… roughly double where we were before the pandemic.’

Critics aren’t mincing words. Economist Philip Cross, in the Financial Post, warns this “generational investment” schtick—reclassifying everyday pork as “capital” to justify borrowing—is “creative accounting on steroids,” echoing COVID-era money-printing that’ll be hard to reverse, fueling inflation and stagnation.

(Source: marksdeepthoughts.ca)

Economist Jean-Philippe Fournier adds that $250 billion in new spending could strip our AAA credit rating, turning Canada into Greece with better healthcare waits.

And Poilievre’s hammering the coffin shut:

“Mark Carney said Canadians should judge him by the cost at the grocery store. We now see 2 million visits to food banks in a month and one-quarter of Canadians living in food insecurity.”

— Pierre Poilievre (@PierrePoilievre)

Under Liberals, per-capita GDP has flatlined while interest costs doubled, making us the G7’s productivity punchline.

(Source: facebook.com)

This isn’t just rhetoric; the Conservative Party’s (October 2025) analysis of OECD data shows ‘Canada is expected to rank second worst for per capita growth from 2025 to 2030‘ among 48 tracked countries.

It’s not just numbers—it’s lives. Household debt is the G7’s highest, unemployment second-worst, and food-bank usage up 32 % from pre-pandemic levels, with over 2 million monthly visits as grocery inflation outpaces our meagre 1.2 % growth forecast for 2025.

(Source: marksdeepthoughts.ca)

As Fraser Institute’s Jake Fuss puts it, quoting Orwell, this is “doublethink”: austerity and investment, pain and prosperity.

“The markets will have had enough,” he warns. “The damage is so catastrophic that restoring Canada’s fiscal health will require years of effort—and it will be extremely painful.”

— @cbcwatcher

“Generational Investments”? More Like Generational IOUs

Carney’s big pitch: a “new Capital Budgeting Framework” to separate day-to-day waste from “investments” in housing, green tech, and infrastructure—financed, of course, by debt.

Sounds noble, until you realize it’s a semantic shell game allowing almost any expenditure to be labeled “long-term investment.”

(Source: marksdeepthoughts.ca)

The PBO calls the definition “too broad.”

Opposition MPs from Conservatives to Bloc Québécois decry it as misleading.

Poilievre dubs it “printing money for Liberal largesse,” while X users erupt:

“This is Liberal trickery—generational debt, not investment.”

(Source: marksdeepthoughts.ca)

Desjardins economists forecast deficits hitting 30-year highs—$74.5 billion this year and $70 billion next—calling Carney’s gamble a recipe for crisis.

(Source: biv.com)

Rebel News adds: “Canadians who are struggling are being told to make sacrifices while the PM runs up the tab.”

(@RebelNews_CA)

Even the NDP is piling on, confirming fears of pain for the already pinched.

(Source: ndp.ca)

And Poilievre’s fire alarm?

“Cap spending before the dam breaks.” (@PierrePoilievre)

With net investment outflow at $53.9 billion, 86,000 job losses, and productivity stagnant, this “investment” feels like betting the farm on a three-legged horse.

Companies Fleeing Faster Than Trudeau from a Tough Question

Investment is dropping so fast that Statistics Canada (Aug 28, 2025) reported the ‘Highest foreign divestment in Canadian securities since 2007.’ In the second quarter alone, foreign investors dumped $16.8 billion, contributing to a staggering $85.9 billion net outflow of funds in the first half of 2025.

Businesses slashed machinery investment by 9 % in Q2, the steepest G7 decline.

Poilievre nails it:

“Over a half-trillion of net investment has fled since Liberals hiked taxes and blocked projects. Now Carney wants to shove another trillion south? Lost jobs, lower wages, higher prices.”

— @PierrePoilievre

The pullback is widespread. A Q3 2025 report from the Altus Group noted that commercial real estate investment ‘fell sharply,’ with total dollar volume down ‘a 22% decline year-over-year,’ reflecting ‘investor caution in deploying capital.’

Pissing Off Big Brother: Doug Ford’s Ad and Trump’s Tariff Tantrum

Enter Doug Ford, Ontario’s brash premier, dropping a $73 million ad blitz south of the border—featuring Ronald Reagan crooning that tariffs are bad.

Cute, except it misfired like a whoopee cushion at a funeral.

Trump, ever the thin-skinned dealmaker, blew a gasket: “Fake ad!” he raged, halting all trade talks with Canada.

(Source: san.com)

Ford paused the spots on Monday to “resume talks,” but the damage was done.

Trump’s now hell-bent on yanking auto work stateside, slapping 25 % tariffs on our exports.

(Source: michauto.org)

The fallout? Stellantis is shifting $13 billion in U.S. investment from Ontario plants, axing 3,000 Canadian jobs—“a direct consequence” of Trump’s tariffs, per Carney himself.

(Source: theguardian.com)

Ottawa’s slashing exemptions for U.S. vehicles from GM and Stellantis, as Trump urges Big Three to “dominate” manufacturing down south.

(Source: cbc.ca)

Our auto sector? Toast. As Politico put it, Trump’s trade war just claimed its first plant-wide casualty north of the border.

(Source: politico.com)

The Reckoning: From Carney’s Steroids to a Broke Tomorrow

Carney rode in on promises of tight ships, but he’s Trudeau on steroids—promising home runs while striking out on basics.

As X user @MarcNixon24 blasts:

“He’s planning to borrow nearly twice as much as Justin Trudeau… It’s not only bad economics—it’s unethical.”

— @AaronGunn

With debt-to-GDP creeping toward 50 %, C.D. Howe warns of rate spikes bankrupting provinces and households.

(Source: marksdeepthoughts.ca)

Our kids? They’ll never afford homes in this “invested” dystopia—food banks for millennials, tent cities for Gen Alpha.

Poilievre’s right: “You have sacrificed enough.”

(Source: youtube.com)

Time to cap the spending, axe the taxes, and lure investment home before Trump builds that wall and the moat.

Otherwise, Canada’s not just broke—it’s the family joke, disowned by big bro and lectured by a PM who thinks “sacrifice” means your Netflix subscription.

Wake up, eh?

Before the only thing generational is the regret.

Leave a comment