The Grand Illusion of Recovery

The Grand Illusion of Recovery

As the maple leaves unfurl in the Canadian spring of 2024, so too does the federal government’s budget, promising growth and resilience in a post-pandemic world. However, beneath the veneer of optimism, the budget document reveals not just an underestimation of lingering economic ailments but a potentially perilous oversight of the very fabric that holds Canada’s economy together.

Canada, like many nations, has been navigating the treacherous waters of economic recovery following the global pandemic that swept through our lives like a prairie fire. The 2024 budget, with its gleaming projections and ambitious promises, suggests a pathway not just to recovery but to a flourishing future. Yet, a critical analysis—inspired by the incisive perspectives of Conrad Black’s historical economic narratives and Jordan Peterson’s deep dive into the cultural underpinnings of societal issues—reveals a more troubling picture painted over with too broad a brush of optimism.

The Debt Albatross

At the heart of the issue is the national debt—swollen from years of necessary pandemic spending but now morphing into a potentially unmanageable beast. The 2024 budget glosses over the grave long-term implications of this debt, opting instead for a narrative of manageable deficits and decreasing debt-to-GDP ratios. However, the reality is that every Canadian is now bearing a heavier fiscal yoke, with future generations inheriting the obligations of today’s spending. Without a clear plan for tackling this debt, Canada risks economic sovereignty, shackled to the whims of international lenders and market fluctuations.

Quantitative Easing: A Double-Edged Sword

Quantitative easing was a salve during the worst months of the pandemic, intended to stabilize and inject liquidity into the Canadian economy. Yet, this intervention has accelerated inflationary pressures that now manifest in doubled home prices and soaring living costs. The 2024 budget’s scant attention to the direct consequences of these policies on ordinary Canadians—many of whom now grapple with the reality of unaffordable housing and increased cost of living—is a glaring omission. The narrative spun in the halls of power may speak of growth and inflation control, but the streets tell a different story—one of hardship and disillusionment.

The Housing Market on the Brink

Nowhere are the effects of inflation more evident than in the housing market. With mortgage rates at heights unseen in four decades and housing affordability at an all-time low, a significant portion of Canadians find themselves on the precipice of financial ruin. This budget’s failure to address or even acknowledge the bubble, or the potential for widespread defaults, is not just an oversight—it is an abdication of the government’s duty to foresee and forestall economic crises.

A Nation Hungry for Truth

The use of food banks—a barometer of societal well-being—has reached record levels, a testament to the widening gap between the budget’s glossy figures and the gritty reality faced by many Canadians. The disconnect between projected economic benefits and the lived experiences of the populace underscores a profound need for a budget that addresses the real and urgent needs of all its citizens, rather than projecting an unfounded narrative of universal prosperity.

Charting a Path Forward

What Canada requires now is not a continuation of the grandiose spending of yesteryears but a pivot towards fiscal prudence anchored in reality. This involves making tough choices about spending, prioritizing essential services and infrastructure, and laying out a clear, realistic plan to reduce national debt. Moreover, targeted support must be extended to those still reeling from the pandemic’s fallout—through direct aid and by fostering job creation in sectors most likely to contribute to sustainable economic growth.

The 2024 budget could have been a beacon of hope, a plan robust in its pragmatism and rich in its understanding of the challenges at hand. Instead, it risks becoming a missed opportunity, cloaked in the illusory comfort of short-term gains. For Canada to navigate successfully through the lingering economic fog, it will need more than optimistic projections and fiscal sleight of hand; it will require a return to the foundational principles of prudence, transparency, and, above all, a commitment to the real welfare of its people. As we move forward, let it be with a clear-eyed view of our circumstances, armed not just with hopes and dreams, but with strategies and systems robust enough to withstand the tests of time and reality.

The budgets laid out by the Canadian government in 2016 and 2024 provide a comprehensive view of the fiscal intentions and economic predictions made at two different points in time. This analysis seeks to scrutinize the projections and actual outcomes associated with these budgets, specifically examining the accuracy and potential flaws in the 2024 budget forecasts, with a particular focus on historical data’s role in shaping these forecasts.

Economic Context and Assumptions

2016 Budget: The economic plan presented in 2016 focused on stimulating growth through infrastructure spending and targeted investments in the middle class and social programs. The government projected a moderate deficit but emphasized a low debt-to-GDP ratio, maintaining fiscal health while investing in growth sectors (like clean technology and public transit).

2021 Budget

By 2021, the landscape had dramatically shifted due to the COVID-19 pandemic, necessitating extensive government intervention. The 2021 budget aimed at recovery, with significant expenditures toward job creation, supporting businesses, and sustaining health services amidst the ongoing crisis. This budget also included plans for long-term growth post-pandemic, highlighting investments in digital transformation and green initiatives

2024 Budget

In contrast, the 2024 budget arrives in a different context, with higher debt levels exacerbated by the COVID-19 pandemic’s financial demands. The predictions in this budget include slow economic growth, a slight increase in unemployment, and significantly higher debt servicing costs. The government continues to focus on infrastructure, housing, and green projects but with much higher deficit levels projected.

Forecasting and Historical Data

The 2024 budget predictions appear to lack a detailed retrospective analysis that connects past economic shifts with present forecasts. For example, the document does not clearly outline how the outcomes of investments made in 2016 influenced the decisions for 2024, nor does it sufficiently compare past forecast accuracies to adjust current predictions. This omission can be crucial, as understanding the effectiveness of previous policy measures (e.g., the impact of the middle-class tax cuts and child benefits introduced in 2016) is key to projecting future outcomes accurately.

Potential Misleading or Ambiguous Statements

The 2024 budget’s optimistic outlook on avoiding a recession despite slow growth projections and a high debt-to-GDP ratio could be seen as overly optimistic or misleading, given the external economic pressures and internal fiscal challenges highlighted. The document does not fully account for how these challenges could realistically affect its growth and deficit targets.

Historical Data and Forecasting Accuracy

A significant flaw in the 2024 budget could be its insufficient use of historical data to inform economic forecasts. While the budget mentions demographic changes and housing needs, it does not robustly link these factors with concrete fiscal policies from past years that have shown measurable outcomes. This lack of historical grounding may lead to what some could interpret as “cleansed” data usage, where only favorable outcomes are highlighted to justify new spending.

Key Areas of Concern in the 2024 Budget -Underestimation of Natural Debt Consequences

The 2024 budget’s treatment of national debt appears optimistic, possibly underplaying the long-term burden that elevated debt levels could impose. Post-pandemic spending has significantly increased the national debt, which necessitates a more cautious approach to new fiscal policies. High debt levels can constrain future government spending and might necessitate austerity measures that could impact economic growth negatively.

Impact of Quantitative Easing and Inflation

The Bank of Canada’s response to the COVID-19 crisis included significant quantitative easing which has inflated asset prices, notably in the housing market. The budget does not adequately address the resultant doubled home prices and the broader inflationary pressures that are beginning to materialize. This oversight can lead to under preparedness for handling ongoing inflation which affects everyday Canadians, especially those with fixed or low incomes.

Soaring Mortgage Rates and Housing Affordability

The surge in mortgage rates, reaching highs not seen in over four decades, compounds affordability issues, yet receives limited attention in the 2024 budget. This trend threatens to increase mortgage defaults, place more individuals in financial distress, and could lead to a housing market correction that would have severe economic repercussions.

Increase in Poverty Indicators

Record numbers of Canadians utilizing food banks and a potential rise in mortgage defaults are critical indicators of underlying economic stress not sufficiently addressed in the budget. These issues signal that many Canadians are not experiencing the recovery as evenly as projected, and there is a need for targeted interventions to support these vulnerable populations.

Recommendations for a More Realistic Budget Approach

Enhanced Transparency and Data Use

The government should adopt a more transparent approach by incorporating comprehensive economic data and realistic scenarios in its budget forecasts. This involves acknowledging the full impact of inflation, debt levels, and the uneven economic recovery.

Fiscal Prudence

Given the current economic uncertainty and the potential for prolonged inflation or other economic hardships, a more conservative fiscal approach might be warranted. This could include setting stricter priorities for spending, focusing on essential services and infrastructure, and avoiding expansive new programs without clear, sustainable funding sources.

Targeted Support Measures

To address the disparities in recovery, the budget should include specific measures for those hit hardest by the pandemic’s economic effects. This includes supporting housing affordability, providing relief for indebted Canadians, and enhancing food security initiatives.

Long-Term Economic Planning

The government needs to outline a clear, long-term strategy for economic resilience that considers potential global economic shifts, including changes in trade, labor markets, and international relations. This strategy should emphasize sustainable growth, reducing reliance on debt-fueled spending.

It’s Magic

The 2024 budget’s out, and as I flip through it, there’s a distinct aroma of smoke and mirrors trying to spruce up what’s shaping up to be a less-than-stellar period. Now, cast your eyes on the chart they’ve served up. To the untrained eye, it might pass off as a feel-good, rah-rah graph that screams ‘trust us, we’re on a roll.’ But those of us who can spot the difference between a fact and a punchline know better. There’s a sneaky suspicion that this chart might just make the Trudeau government look like financial Houdinis. Hold your applause, folks. Before we crown anyone a budgetary genius, let me break it down for you—spoonful by spoonful—why this chart is more ‘comedy central’ than central banking.

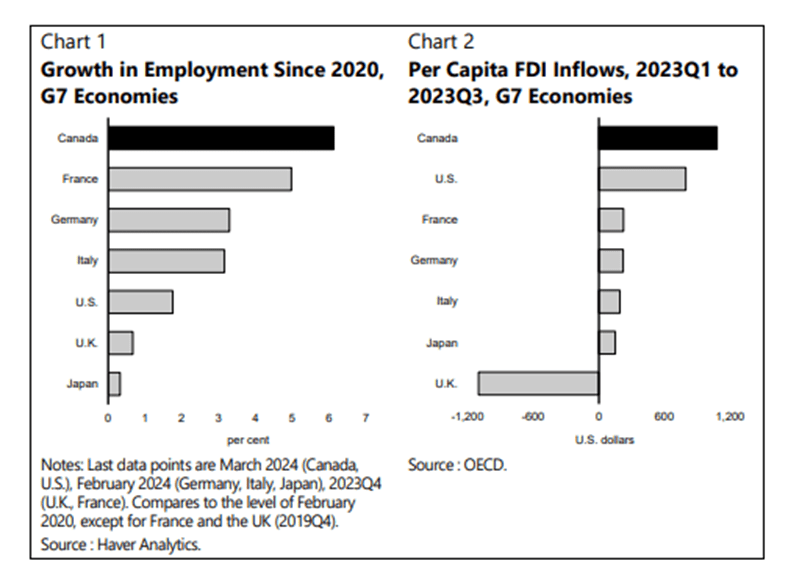

The charts provided aim to display the growth in employment since 2020 for G7 economies and per capita FDI (Foreign Direct Investment) inflows for the third quarter of 2023 compared to the first quarter of 2023 for the G7 economies. Let’s discuss potential flaws or areas where these charts may lack in providing a complete understanding:

- Lack of Baseline/Zero Axis Consistency: Ideally, bar charts should start from a common baseline (usually zero) to ensure that the length of the bars accurately reflects the magnitude of the values they represent. In Chart 2, the bars extend in both directions from the axis, but there is no clear indication of what the baseline value is (zero or otherwise), which can be misleading.

- Scaling Issues: The scales on the y-axis of both charts are unclear. For Chart 1, without knowing the exact scale and whether it is linear or logarithmic, interpreting the data accurately is challenging. For Chart 2, the negative to positive scale makes it difficult to assess the magnitude of changes in FDI inflows.

- Absence of Timeframe Reference for Chart 1: Chart 1 does not specify the timeframe over which employment growth is measured. Without this, it is hard to know whether these are annual growth rates, cumulative since 2020, or over another period.

- Lack of Data Normalization: In Chart 2, the per capita measurement is a form of normalization, but without knowing the populations or the absolute FDI values, the context is missing. A country with a small population and modest FDI inflows could appear to have a high per capita rate, which can be misleading when compared to larger economies.

- No Clear Definition of Terms: The term “growth in employment” is vague. Does it refer to the number of employed individuals, the rate of employment growth, or employment relative to population growth? Similarly, “FDI inflows” should be clarified as to whether they represent new investments, net investments after outflows, or some other measure.

- Use of Different Time References: The data points for Chart 1 come from various years and months, which means the conditions under which they were collected differ, potentially skewing the comparison.

- Exclusion of Relevant Information: For a comprehensive analysis, information such as the state of the economies prior to 2020, the impact of COVID-19, and any government interventions that could affect employment or FDI should be included.

- Visual Representation Issues: The bars in Chart 2, particularly for the U.K., appear to go beyond the scale provided. This could either be an error in the graphic representation or a lack of appropriate scale increments.

- Source and Notes: While the charts cite OECD and Haver Analytics, there is a lack of clarity on how these figures were derived and what adjustments or indices were used. Furthermore, notes such as “last data points” and “except for France and the UK (2019Q4)” require further explanation to understand their significance.

These are general observations based on the image provided. A thorough critique would also consider the accompanying text or data definitions that should ideally be part of any report or presentation involving such charts.

Now let’s look at the next chart of financial wizardry, I will spare you the build up and simply present the chart with my critique.

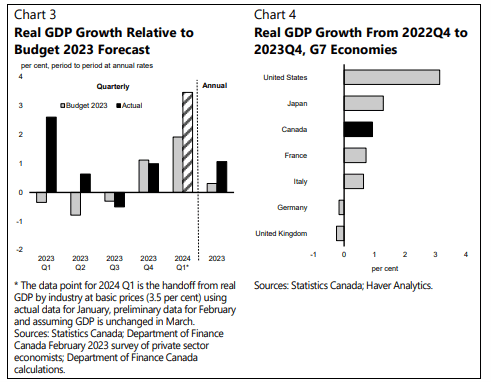

Okay, let’s dive into this like it’s the deep end of the graph pool. Chart 3 on GDP growth is like a bad date—it leaves you with more questions than answers. There’s a footnote that’s about as clear as a politician’s promise, talking about ‘handoff’ data points. I mean, come on, if you need an asterisk to explain your chart, maybe it’s time to go back to the drawing board. And the actual forecast line bails out quicker than a CEO after a stock plunge—what happened to Q4, did it take a sabbatical?

Then there’s this annual marker playing hopscotch over the bars. Decide already—what year are we talking about? And that Q4 prediction—it drops faster than my Wi-Fi signal. Where’s the context? Did the future suddenly look so grim we needed to predict an economic horror story?

Switching to Chart 4, it’s like they forgot how to compare numbers. We’ve got growth rates with no base year—is this a sequel, prequel, reboot? Who knows? The UK’s growth looks like it took a nosedive off a cliff. Was there an economic Brexit that nobody told us about?

Now, the economists throw in some spicy lingo— ‘surging’ this, ‘rapidly’ that. It’s like they raided a thesaurus to make inflation sound like a summer blockbuster. They cherry-pick a sky-high inflation rate from last year, skipping the build-up like it’s the boring part of a movie. And sure, they tell us falling energy prices and supply chain fixes are saving the day, but without the numbers, it’s like saying you won the lottery without showing us the ticket.

The grand finale? Inflation’s big comeback story. Sure, it’s in the target zone now, but let’s not break out the champagne yet. Shelter costs are still doing the limbo under that interest rate bar. So, while the bigwigs want to take a victory lap for taming the inflation beast, we’ve still got a few chapters to go in this economic saga. Remember folks, it’s not just about the numbers; it’s about the story they’re telling. And right now, that story needs a rewrite.

What are they not telling us?

Well, let me tell you, it’s not all mom and apple pie kids, this budget book that makes Peace and War seem like a Marvil comic, seems to gloss over some cold hard facts. Let’s take a stroll down Reality Drive.

Gobbledygookgook Speak

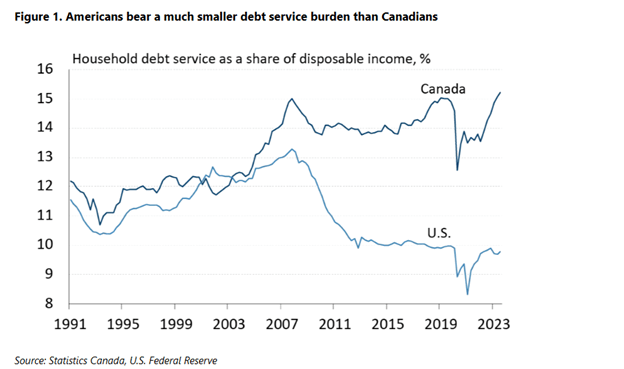

Alright, let’s strip down the econo-speak and lay it out bare like a late-night tweetstorm. So, Uncle Sam and Cousin Maple Leaf have been hiking up interest rates like they’re competing in some kind of fiscal Stairmaster challenge. But lo and behold, Canada’s economy seems to have pulled a hamstring, growing at a pace that makes snails look speedy. Last year, while the Yanks cruised at a 2.5% growth, Canada was huffing and puffing at 1.1%. And let’s not even talk about domestic demand in Canada—it’s like that guy at the party who just can’t take a hint.

We folks up north, are drowning in debt like it’s a national sport, and with mortgage terms shorter than a celebrity marriage, the interest rate bite is more like a shark attack. Picture this: Canadians are forking over more than 15% of their hard-earned cash just to keep up with debt payments, while Americans are chilling below 10%. Blame it on the housing market going bonkers after the Financial Crisis while Americans were tightening their belts.

And don’t get me started on the consumption saga. We Canadians are about as eager to spend on goods as a teenager is to clean their room. We’ve got services growing at a ‘meh’ pace, but when it comes to durable goods, the Canadians are like, “Nah, we’ll pass.” This spending stage fright is even weirder since Canada’s population has been popping up faster than the U.S. Thanks to our immigration policy which is pretty much a joke.

Looking forward, Canadian wallets might stay on lockdown with mortgage renewals on the horizon and a labor market that’s about as robust as a wet noodle. And hey, inflation might be cooling off, but don’t throw a parade yet—it’s like saying you’re on a diet because you only had two donuts instead of three.

So what’s the bottom line? Bond yields in Canada are doing the limbo, and with the Bank of Canada acting tougher on rates than a bouncer at a club, don’t expect a rate cut rave anytime soon. But hey, plot twist—once inflation decides to take a hike, those rates might just follow suit, and we could see the yield curve straighten up like a teenager when you mention Wi-Fi outage.

And for the loonie, it’s been taking a bruising, but with the U.S. dollar expected to step off the gas, Canada’s dollar might just find a second wind. So grab your popcorn, because the Canadian economy might just pull a plot twist yet.

As for the man behind these numbers? Krishen Rangasamy, the economic maestro at FCC, has been dishing out forecasts like a pimpled-faced teenager smacks together burgers on a McDonald’s assembly line. Before he set up shop at FCC, he was the Bay Street go-to guy, whispering sweet nothings about the economy into the ears of traders and hitting the airwaves with his market musings. And before he played with big money, he was knee-deep in the energy biz out west. His economic playbook? Simon Fraser University.

It doesn’t end there kids, not in the least. With our country hemorrhaging like a hemophiliac, our leader who I wonder if he has been sniffing glue, is using his AMX to pay off his Mastercard that he used to pay down his Visa that he used to pay his AMX, crazy as shit I know, but hear me out.

Alright, gather ’round, folks. Let’s break this down like it’s trivia night at the pub. The head honcho of the Bank of Canada dropped a bit of a bombshell—turns out, government spending has been acting like kindling on the inflation bonfire. That’s right, all that cash splash from the powers that be has left interest rates perched higher than a cat in a tree.

And let’s talk about the big elephant in the room, or should I say, the big liberal elephant. Our pal Justin Trudeau has been whipping out the national credit card like he’s got points to claim, racking up more debt than all the PMs who came before him put together, and that is not hyperbole, that is an actual fact. And just for a little perspective, the tab for all that spending? It’s so big that this year, the dough we’re throwing just to cover the interest on that debt is going to beat what we spend on health care. Yeah, let that sink in.

Now, if you’re an average Joe or Jane with a regular house and a mortgage that’s about 350k, you’re getting squeezed extra—like up to 7 grand a year extra—thanks to the spending spree of the current government. That’s not chump change; that’s a vacation, a used car, or a whole lot of pizza nights you’re missing out on, or I don’t know, saving for a rainy day?

As the purse strings tighten, nearly two million Canucks had to hit up a food bank last month. And just when you thought your paycheck could take a breather, along come the rising prices for gas, heating, and groceries, gobbling up every extra cent.

But fear not, says the Conservative’s finance guy, Jasraj Singh Hallan. He’s got a plan to clean up this mess with what he calls “Common sense Conservatives.” They’re talking about snipping away the waste, taming the wild inflation beast, and getting those interest rates down to earth so Canadians can keep a bit more bacon from their pay and, you know, not have to choose between a full tank of gas and a full fridge.

Other Glaring Issues:

Given this charming passage in the budget, here is another glossy chart without any comparable data to provide context beyond their narrative which is, “Just look at nice chart with these handpicked numbers.”

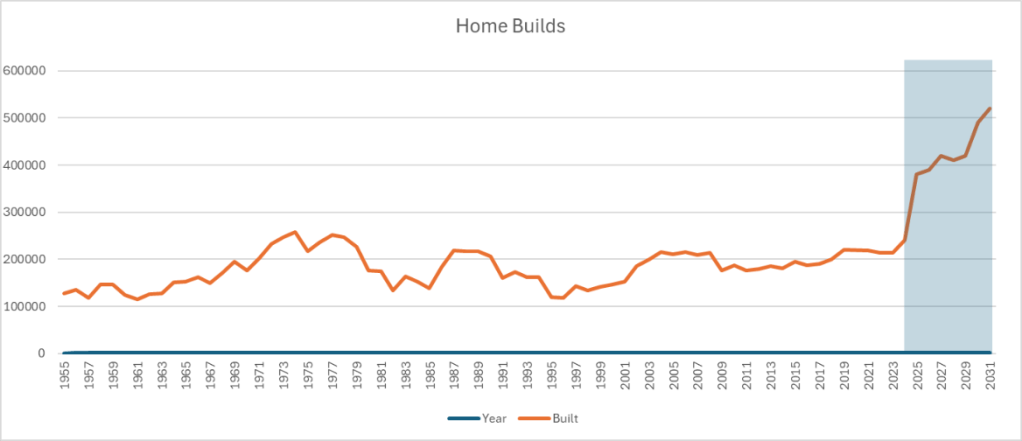

Okay, let’s talk about this and add some context anyone can find with a little Google search. Canada’s housing scene is looking like a game of musical chairs with nowhere near enough seats when the music stops. So here’s the headline: Toronto and its band of merry Canadian metros are cramming in more people than a clown car, but who forgot to build the actual houses? The Fraser Institute just dropped a report that’s pretty much a numbers nerd’s nightmare, showing Canada’s been on a people-packing spree, adding half a million buddies to the party every year, but only whipping up a measly 200K homes to put them in.

Ontario’s been hit by the housing equivalent of a fast ball, welcoming 240K newbies each year with a sad trombone playing for the 71K homes it managed to build. And let’s not give a free pass to British Columbia and Alberta; they’re playing the same lousy game of catch-up.

FUN FACT

Here’s a fun fact: Canada was actually building more houses back when bell bottoms were cool, in 1974. That’s right, they put up more walls and roofs when the population was a lean 23 million than they do now with 38 million folks elbowing each other for space. Fast forward, and Alberta’s practically printing invites at this point with 2.4 new folks for every house since the ’70s.

And just when Atlantic Canada thought it was safe to ignore the housing hubbub, 2022 said, “Hold my lobster,” with New Brunswick hosting a population boom so big, the housing market’s knees are buckling.

Oh, and if you’re a numbers geek, here’s a stat to chew on: Canada’s got the saddest housing-to-human ratio in the G7 clubhouse, trailing with 242 homes per 1,000 peeps. To play catch-up, Canada needs to hammer out 1.8 million new homes, stat.

But wait, there’s more! The Canada Mortgage and Housing Corp’s crystal ball says, “You think that’s bad? Try 3.5 million new digs by 2030 to get back to the good old days of actually being able to afford a home.”

So, as the script goes, Canada’s housing plot is more twisted than your 3-year-old granddaughter with gum in her hair, and if someone doesn’t start laying bricks faster than a pizza oven at a block party, well, let’s just say it’s going to be a tight squeeze. And if you’re the average Canadian watching your dream home turn into a pumpkin because the Liberal government’s been throwing cash around like it’s confetti, remember that extra 5 to 7K you’re coughing up for your 350K mortgage? Yeah, you can thank them for that little gift that keeps on taking.

The total expenses projected for the Canadian government in 2024-2025 are approximately $534.6 billion. Here is a breakdown of the high-level categories of spending:

- Infrastructure: Includes $35 billion invested by the Canada Infrastructure Bank across various sectors such as clean power, green infrastructure, public transit, and broadband.

- Indigenous Priorities: Approximately $32 billion is allocated for Indigenous priorities, reflecting a significant increase from previous years.

- National Defence and Security: This includes funding for the Department of National Defence, the Canadian Security Intelligence Service, and other national security initiatives, amounting to over $125 billion in incremental funding over 20 years.

- Public and Other Social Services: Funding includes investments in health, education, child and family services, housing, and infrastructure to support various community needs across the country.

- Debt Payments: Interest and other public debt expenses are projected to be $54.1 billion for the fiscal year.

To calculate the per capita spending for each Canadian, we can use the projected total expenses of $534.6 billion divided by the estimated population of 40 million people in Canada:

Per Capita Spending=Total ExpensesPopulation=534.6 billion40 millionPer Capita Spending=PopulationTotal Expenses=40 million534.6 billion

Let’s compute this to get the exact figure per person.

The projected per capita government spending for 2024 in Canada is approximately CAD 13,365 per person. This amount represents the total government expenses divided across the estimated population of 40 million people.

Canada has now surpassed China to lead globally in the attractiveness of building electric vehicle battery supply chains. This accolade is touted to signify a boost in high-skilled, well-paying jobs across diverse sectors—from mining critical minerals essential for car batteries to manufacturing and transportation logistics.

However, this glowing endorsement and the ambitious goals set forth in the budget raise substantial questions in light of recent market dynamics and infrastructural challenges. For instance, the surge in EV sales has not been without its hurdles; several major auto manufacturers are scaling back their EV initiatives due to financial underperformance and logistical complications. Furthermore, Canada’s existing power grid, which is deemed outdated by some standards, might struggle to support the rapid increase in EVs without significant upgrades.

The budget’s projections might seem overly optimistic considering these real-world challenges. While the government’s major economic investment tax credits aim to leverage Canada’s potential in clean energy, rigorous labor standards, and a strong ethos of Indigenous consultations, the feasibility of growing the clean energy GDP fivefold by 2050, as proposed, seems ambitious. This growth is predicated on the assumption that good climate policy seamlessly translates into good economic policy, yet the practicalities of such a transformation—particularly in the context of current technological and market limitations—remain to be convincingly addressed in the fiscal documents.

As Canada endeavors to reach net-zero emissions by 2050, the budget’s forecast and the underlying strategies should ideally reflect a more balanced view, incorporating contingency plans for economic fluctuations and potential technological evolutions in the EV market. This would ensure a more resilient economic framework that can adapt to the rapid changes characteristic of global energy and automotive markets.

I would estimate the 500 billion in revenue stream by 2050, may not even achieve another 10 billion if we take into account the realities and trends we are seeing now, in fact this could start heading the opposite direction.

While the 2024 budget does address various economic scenarios, historical context and past budget predictions underscore a pattern of overly optimistic forecasting that doesn’t fully encapsulate the prevailing economic challenges.

For instance, the 2023 budget projected strong economic recovery and resilience, highlighting robust job markets and significant investments in clean energy and public health (see Deputy Prime Minister’s Foreword, Budget 2023). However, the actual economic developments throughout the year revealed that these projections did not fully materialize as expected. Challenges such as persistent inflation, unexpected global financial pressures, and slower GDP growth exposed the gaps between the budget’s optimistic projections and the real economic conditions faced by Canadians (see Economic Overview, Budget 2023).

Similarly, the 2024 budget continues on this trajectory of optimistic forecasts. While it discusses comprehensive measures to address potential economic downturns and inflationary pressures, the predictions might not be grounded in the full reality of potential adverse global economic shifts. The past budgets, including those of 2023 and earlier, have often underestimated the depth and impact of such downturns, which suggests a recurring pattern of mismatch between projected and actual economic conditions.

Moreover, we are on the brink of seeing the full impact of these economic challenges as homeowners begin renewing mortgages that were initially secured at rates as low as 2%. With current rates potentially doubling or tripling, this shift is likely to deliver a serious blow to the economy, representing a significant financial strain for many Canadian households. This looming issue highlights a critical oversight in the budget’s optimistic economic narrative and projections.

Therefore, when analyzing the 2024 budget, it’s crucial to consider this historical context of optimistic projections that often fail to fully capture the economic difficulties ahead. This pattern suggests a need for a more cautious fiscal approach that prepares for and articulates a broader range of economic risks, ensuring that all Canadians are better equipped to face the uncertainties of our future economic landscape. This context is essential for a more realistic and practical public fiscal policy discussion.

Let’s talk about the 4 million homes the budget promises to build by 2031 and can we please apply some simple math to illustrate this is truly something that is logistically impossible.

To achieve the 4 million homes by 2031, approximately 1,728 homes would need to be built each and every working day out of the 1,505 working days remaining.

At the current annual build rate of 200,000 homes, without acceleration, it’s estimated that 1.4 million homes will be built by 2031. To reach the government’s target of 4 million homes, an additional 2.6 million homes are needed.

Given the industry standard for actual working days in Canada, after accounting for vacations, holidays, and bad weather, we estimate there are about 215 working days per year. Over the next 7 years, this equates to approximately 1,505 working days in total.

To meet the government’s target by 2031, there would need to be about 1,728 homes built every single one of those 1,505 working days. This is a significantly higher rate than the current pace, and it underscores the challenge of meeting the government’s objective of 4 million new homes within the given timeframe. Achieving this goal would likely require substantial acceleration in homebuilding processes, an increase in the labour force, improved efficiencies, and potentially new construction technologies.

A Final Word

While the 2024 Canadian budget aims to set a course for recovery and growth, it risks overlooking significant economic pressures that could undermine these goals. By realigning budgetary projections with more conservative and data-driven approaches, and addressing the immediate economic pain points of its citizens, the government can better navigate the post-pandemic landscape and ensure a stable economic future for all Canadians.

To improve transparency and accuracy, the 2024 budget should incorporate a more detailed historical analysis to better justify its projections and spending increases. Such an analysis should include:

- A comparative study of forecast accuracies over the past budgets.

- An evaluation of long-term impacts of key policies initiated in 2016.

- A realistic assessment of external risks that could affect fiscal plans.

While the budget aims to address Canada’s economic needs, the 2024 budget could improve its credibility by thoroughly integrating historical economic data and outcomes into its forecasts. This approach would not only enhance the transparency of the document but also provide a more solid foundation for the projections and policies it advocates.

Perhaps if our government were not dealing with all the scandals and RCMP investigations they might have performed better, but something tells me not as it seems our narcissistic leader is crashing our country in the same manner, he is crashed his personal life. Soon the liberals will be done, and not a moment too soon, but it will take years for the next government to unravel what Trudeau has done. I predicted over three years ago, the collateral damage the liberals will leave will be generational, and so it seems this is unfolding before our eyes. There you have it—economics without the jargon, served up fresh.

Leave a comment